LIC Jeevan Shanti – Single Premium Guaranteed Pension Plan

Key Features- Single Premium Annuity Plan – Immediate or deferred annuity

- Guaranteed Annuity Rates at the inception of the policy for both annuity types

- Annuity Option fixed at the time of opting policy. No change in the selected option is allowed.

- 10 different immediate annuity options.

- Joint life annuity option available.

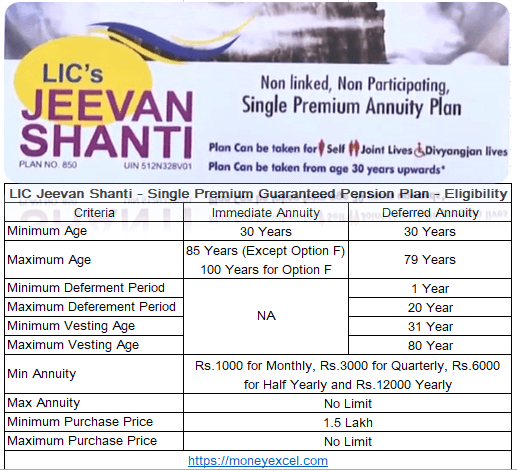

From above eligibility details it is clear that minimum purchase price for this policy is 1.5 Lakh and minimum annuity is Rs.1000 per month. (Rs.12000 yearly).

Annuity Options

- Option A Immediate Annuity for life

- Option B Immediate Annuity with a guaranteed period of 5 years and life thereafter

- Option C Immediate Annuity with a guaranteed period of 10 years and life thereafter

- Option D Immediate Annuity with a guaranteed period of 15 years and life thereafter

- Option E Immediate Annuity with a guaranteed period of 20 years and life thereafter

- Option F Immediate Annuity for life with return of Purchase Price

- Option G Immediate Annuity for life increasing at a simple rate of 3% p.a.

- Option H Joint Life Immediate Annuity for life with a provision for 50% of the annuity to the Secondary Annuitant on the death of the Primary Annuitant.

- Option I Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives.

- Option J Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives and return of Purchase Price on the death of the last survivor

- Option 1 Deferred annuity for Single Life at vesting age

- Option 2 Deferred annuity for Joint Life at vesting age

LIC Jeevan Shanti Plan – Benefits

Benefits of LIC Jeevan Shanti plan for immediate annuity.

Benefits payable on Survival

Annuity Option A to F – For Single Life – Annuity Payments in arrears as per the chosen mode of annuity.

Annuity Option G – For Single Life – Annuity Payments in arrears as per the chosen mode of annuity + Increase in annuity payment @3% per annum for every completed policy year.

Benefits payable on Death

Annuity Option A & G – Annuity Payment shall cease.

Annuity Option B to E – On death of annuitant during guaranteed period of 5/10/15/20 years, nominee receives annuity payments till expiry of guaranteed period.

Annuity Option F – Annuity Payment shall cease. Purchase price shall be payable to nominee.

Annuity Option H – On the death of the primary annuitant – 50% of the annuity amount to the surviving secondary annuitant till his/her survival.

Annuity Option I & J – 100% of the annuity amount shall continue to be paid as long as one annuitant is alive.

Benefits of LIC Jeevan Shanti plan for the Deferred annuity.

Benefits payable on Survival

Option 1 – No payment during deferment period. Annuity payments will be made in arrears to the Annuitant as per mode of annuity.

Option 2 – No payment during deferment period. Annuity payments will be made in arrears to the primary and secondary annuitant.

Benefits payable on Death

Option 1 – On the death of the annuitant during Deferment period – Death benefit to Nominee as per the option exercised by the Annuitant. On the death after deferment period no payment shall be made.

Option 2 –

During the Deferment Period – On first death of either of the covered Life – No payment. On death of the last survivor – Death benefit to Nominee as per option exercise by annuitant.

After Deferment Period – On first death of either of the covered Life – 100% of Annuity amount shall continue to be paid as long as one of the Annuitant is alive. On death of last survivor – No Annuity payment.

LIC Jeevan Shanti – Review

The positive and negative about LIC Jeevan Shanti Policy are given below.

- This plan provides new deferred Annuity option for single and joint life.

- This plan also covers Divyangjan Lives (Handicapped)

- Interest rate (Pension) increases with the increase in Deferment Period.

- Single Policy with Immediate & Deferment Annuity Type.

- First policy to have Joint Life pension option with parents and grandparents.

- Annuity increase with rate of 3% is at lower side. Inflation is increasing at much faster rate.

- This plan offers 2% discount on online purchase so, it is better to purchase online.