NPS: At a Glance

SBI National Pension System is the most economical and least known

Government approved pension scheme for Indian citizens in the 18-60 age

group. It was launched by Pension Fund Regulatory and Development

Authority (PFRDA) in 2004. The minimum yearly contribution is Rs 6,000, which either can be paid in one go or in installments of at least Rs 500.

What is National Pension Scheme?

National Pension Scheme being the

cheapest market linked retirement plan among all other Retirement plans

(EPF, PPF and Mutual Funds) suggests that it would have recorded maximum

number of sales. But due to excessively less payment of

incentive/commission to the intermediaries, it is not getting promoted

by them.

The Scenario when the scheme was

launched was worse, the fund management cost was limited at 0.0009 per

cent and points of presence, or PoPs, where investors open the account,

were not permitted to charge more than Rs 20 per account, regardless of

how big the investment was. Then there was an account opening charge of

Rs 50 for the central record-keeping agency, or CRA, in addition to an

annual CRA fee of Rs 225.

The fund management fee for

non-government funds has now increased to 0.25 per cent and for

government funds it has increased 0.0102 per cent. Also, POPs are

permitted to charge Rs.100 plus 0.25 percent of the investment. This

change will surely act as an encouragement for the agents who will now

actively market the product.

Types of National Pension Schemes (NPS):

There are two types of accounts that NPS offers:

Tier-I Account

It is a basic pension account with limitations on withdrawal

*Before attaining 60 years of

age, only 20% of the contribution can be withdrawn while the rest 80%

has to be necessarily used for buying annuity from a life insurer.

Annuity is a series of payments made at fixed intervals of time .

Annuity plans necessitate the insurer to pay the insured income at

regular intervals until his death or till maturity of the plan.

*After attaining the age of

retirement also (60 years), close to 60% contribution can be withdrawn

and the rest 40% again has to be used to purchase annuity from approved

life insurers.

Tier-II Account

It is a voluntary savings option from which a person can withdraw money limitless.

Fund Managers

The individual/organization that takes

decisions regarding any portfolio of investment (mostly a mutual fund,

pension fund, or insurance fund), as per the stated goals of the fund.

It is necessary to opt for a fund manager while opening the account.

The money is managed by seven fund managers appointed by the PFRDA. The government employees accounts are taken care of by one of the best three government fund managers, LIC Pension Plan, SBI Pension Plan and UTI Retirement Solutions, the money invested by others is managed by one of the six fund managers, ICICI Prudential Pension, IDFC Pension, Kotak Mahindra Pension, Reliance Capital Pension, SBI Pension Funds and UTI Retirement Solutions.

The money is managed by seven fund managers appointed by the PFRDA. The government employees accounts are taken care of by one of the best three government fund managers, LIC Pension Plan, SBI Pension Plan and UTI Retirement Solutions, the money invested by others is managed by one of the six fund managers, ICICI Prudential Pension, IDFC Pension, Kotak Mahindra Pension, Reliance Capital Pension, SBI Pension Funds and UTI Retirement Solutions.

Mentioned below are the salient features of both Tier-I and Tier-II account

| Tier-I | Tier-II |

|---|---|

| In case of Government fund, the contribution from the employee's side is 10% basic salary + dearness allowance with exactly same contribution from the employer. | The contribution is Rs.1000 at the time of account opening or a minimum contribution of Rs.250 per month can also be chosen. Also, it is necessary to maintain a minimum balance of Rs. 2000 at the end of financial year. |

| But in non-government fund, the investor pays Rs.6000; with a choice of paying at least Rs. 500 per installment | - |

| In a Government fund, the default investment is made mostly in Corporate and Government bonds | The investment is a mix of equity, corporate bonds, government funds, FDs, liquid funds etc. |

| In a non-Government fund, the default investment is in stocks, corporate bonds, government funds, FDs, liquid funds etc. | - |

Costs Involved in National Pension Scheme

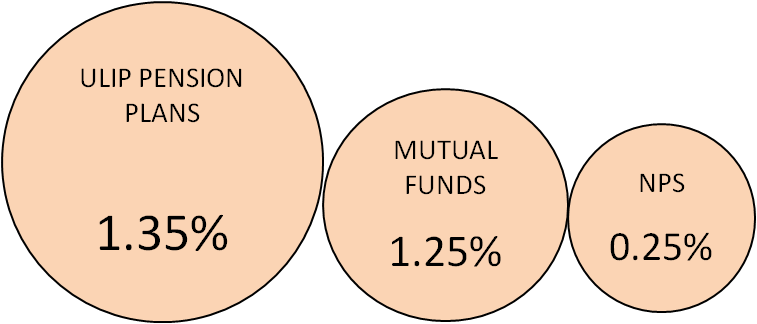

As discussed before the costs involved

are minimal, only 0.25% of the investment is paid to the intermediary as

fund management fee. Let us see how this cost is different from the

costs of the other leading pension plans.

Types of Funds in National Pension Scheme

| Class Of Fund | Invested In | Risk | Average Return Since Launch (%) |

|---|---|---|---|

|

E

|

Index based Stocks |

Carry market risk like any large cap equity fund |

3.79%

|

|

C

|

Bonds issued by State Govt, PSUs and Private Firms |

Going by the quality of companies, risk would be low. |

8.66%

|

|

G

|

Bonds issued by Central Govt. |

Lacks default risk but volatility can't be avoided in long term bonds. |

5.92%

|

Depending

on how open the investor is to risk, the corpus can be divided among

these three fund classes. Exposure to equity cannot be more than 50%.

However if the allocation is not specified, the exposure to various

classes, especially equity is decided on the basis of age.

The above figure also tells us about the average performance of National Pension Scheme funds in different classes.

The investment mix according to the age of the investor:

| Age of the Investor | Percentage of Investment in Various Classes |

|---|---|

| Up to 35 Years | 50% Equity and 50% Debt |

| 40 Years | 40% Equity and 60% Debt |

| 45 Years | 30% Equity and 70% Debt |

| 50 Years | 20% Equity and 80% Debt |

| 55 Years | 10% Equity and 90% Debt |

So with increasing age the investment corpus gets more inclined towards Debt

Pros and Cons of NPS

Pros:

Additional Tax Benefit:

The Finance Bill 2011-12 permits tax

deduction on contribution up to 10 per cent of basic salary and dearness

allowance (DA) made by an employer towards the national pension scheme (NPS) account

of an employee under Section 80CCE. This is over and above the Rs 1

lakh limit and is applicable if the contribution is done by the

employer. This is the reason why corporate houses are accepting NPS

happily.

There has been a hike in inquiries about NPS mainly because of the tax benefit under Section 80CCE.

There has been a hike in inquiries about NPS mainly because of the tax benefit under Section 80CCE.

Higher Fee to Intermediaries:

The fund management fee for

non-government funds has been raised from 0.0009 per cent of assets

under management to 0.25 per cent. The fee for government funds has been

changed to 0.0102 per cent from April this year

PoPs are allowed to charge Rs 100 plus 0.25 per cent of the investment, as against a negligible fee of Rs 20 previously.

The change is promoting New Pension Scheme by offering incentives to distributors and fund managers. The fund management fee of 0.25 per cent is nothing when compared to other products.

PoPs are allowed to charge Rs 100 plus 0.25 per cent of the investment, as against a negligible fee of Rs 20 previously.

The change is promoting New Pension Scheme by offering incentives to distributors and fund managers. The fund management fee of 0.25 per cent is nothing when compared to other products.

Cons:

Tax on Maturity Proceeds:

There is confusion about taxation at withdrawal. According to the present laws the funds would be taxed at withdrawal.

Under the current laws, around 60 per cent corpus on maturity can be withdrawn while at least 40 per cent has to be used to buy annuity. Presently, returns from annuity insurance plans are not tax-free.

The proposed Direct Taxes Code (DTC) plans to exempt NPS funds from tax at withdrawal. However, it is uncertain if the DTC would allow tax exemption on returns from annuity plans as well.

The tax at withdrawal stands in the way of making NPS the best pension scheme.

Under the current laws, around 60 per cent corpus on maturity can be withdrawn while at least 40 per cent has to be used to buy annuity. Presently, returns from annuity insurance plans are not tax-free.

The proposed Direct Taxes Code (DTC) plans to exempt NPS funds from tax at withdrawal. However, it is uncertain if the DTC would allow tax exemption on returns from annuity plans as well.

The tax at withdrawal stands in the way of making NPS the best pension scheme.

Mandatory Annuity:

Another lag is limitation on withdrawal

from Tier-I account, the primary account for pension savings. On

maturity also, one can withdraw only around 60 per cent funds; the rest

has to be used to buy annuity, the returns from which are not tax

exempted.

Even the annuity also has to be bought from one of the six PFRDA-approved insurers. Options to choose from in case of the number of annuity providers are anyway less with LIC commanding a 70 per cent market share.

Even the annuity also has to be bought from one of the six PFRDA-approved insurers. Options to choose from in case of the number of annuity providers are anyway less with LIC commanding a 70 per cent market share.

Low on Equity:

NPS portfolios are restricted to have

more than 50 per cent exposure to equity. It spells loss for people in

their 20s or early 30s, as equity has shown to offer 12-15 per cent

returns per year over long periods.

In comparison to traditional retirement schemes such as EPF and Public Provident Fund, which refrain from investing in stocks at all, NPS is the best as it is a lot more flexible in terms of equity exposure.

So, investors wanting higher equity exposure can go for equity mutual fund schemes such as large-cap funds and equity exchange-traded funds.

In comparison to traditional retirement schemes such as EPF and Public Provident Fund, which refrain from investing in stocks at all, NPS is the best as it is a lot more flexible in terms of equity exposure.

So, investors wanting higher equity exposure can go for equity mutual fund schemes such as large-cap funds and equity exchange-traded funds.

In Comparison to its competitors; EPS and Mutual Funds, NPS leads by

*Scoring better in performance (refer to the investment mix table) and costs

*But the 40% necessary

investment in annuity after attaining the retirement age, 50% cap on

equity exposure and taxation on annuity returns does make NPS a not so

favorable option.

It is for the investor to decide as

performance and costs are good characteristics of NPS that make the

latter shine brighter than its expensive counterparts Such as Mutual

Funds.

Latest News - National Pension Schemes (NPS)

Budget 2017 Brings Relief to the Salaried Individuals Investing in NPS

Delhi, India, Feb 01:

With the release of Budget 2017, there is a relief for salaried

individuals investing in National Pension Scheme (NPS) through their

companies as they can now withdraw 25% of their handouts without paying

any tax. The Government has initiated some amendments in NPS under which

a part of withdrawal from National Pension Scheme is now Tax-free. This

initiative taken by the finance minister Mr. Arun Jaitley has brought a

major relief to the NPS subscribers.

The budget has eliminated the gap

between individual tax-paying employees and self-employed persons in

terms of income tax under section 80CCD. In order to grow the upper

limit of contribution to NPS from 10% of gross total income of a

salaried individual to 20%, the amendment of section 80CCD has been

proposed.

According to the sources, the amendment

will bring equality in tax treatment between the employee and

self-employee or non-salaried individual. The measures taken by the

government will come into action from April 1st 2018 and will be

applicable to the assessment year of 2018-2019.